Want to know how long you’ll live? This 10-second sit-stand test might have the answer

23/06/2025 14:01

1 views

Popular News

-

Mahbub Anam replaces Faruque Ahmed as new BPL chairman

Mahbub Anam replaces Faruque Ahmed as new BPL chairman

-

Suchitra Krishnamoorthi faces backlash for claiming Air India crash survivor was ‘LYING’; Deletes post and issues apology

Suchitra Krishnamoorthi faces backlash for claiming Air India crash survivor was ‘LYING’; Deletes post and issues apology

-

'Would be remarkable to choose someone else if their last knock was a 170'

'Would be remarkable to choose someone else if their last knock was a 170'

-

How do graphic designers convert JPG to PDF (Portable Document Format)?

How do graphic designers convert JPG to PDF (Portable Document Format)?

-

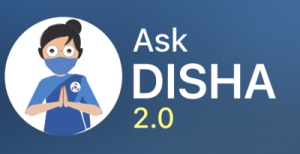

This new AI tool can help you book train tickets, get refunds and check details on IRCTC website and app

This new AI tool can help you book train tickets, get refunds and check details on IRCTC website and app

-

Selena Gomez and Hailey Bieber UNFOLLOW each other amid Justin Bieber drama

Selena Gomez and Hailey Bieber UNFOLLOW each other amid Justin Bieber drama

-

Will Nysa Devgan enter Bollywood like Raveena Tandon's daughter Rasha Thadani? Kajol reveals the truth

Will Nysa Devgan enter Bollywood like Raveena Tandon's daughter Rasha Thadani? Kajol reveals the truth

-

Teen Innovator Soars to New Heights: Mehar Singh Breaks Guinness World Record with Lightning-Fast Drone Ascent

Teen Innovator Soars to New Heights: Mehar Singh Breaks Guinness World Record with Lightning-Fast Drone Ascent

-

India vs England: Can Bazball outplay India's new era? Key battles and what to expect

India vs England: Can Bazball outplay India's new era? Key battles and what to expect

-

iQoo Z9 Turbo new leak reveals key specifications: All the details

iQoo Z9 Turbo new leak reveals key specifications: All the details